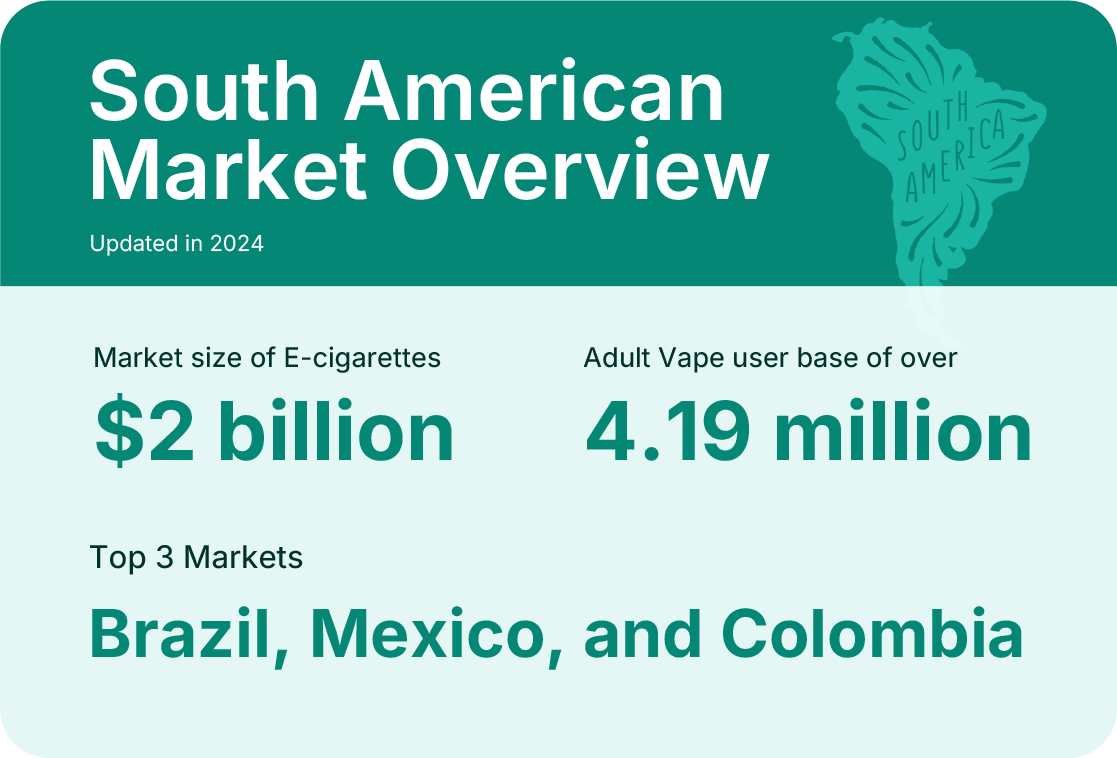

In 2025, the South American e-cigarette market is expected to reach a total size of $2 billion. With an adult user base of over 4.19 million, it is primarily concentrated in the three largest markets: Brazil, Mexico, and Colombia.

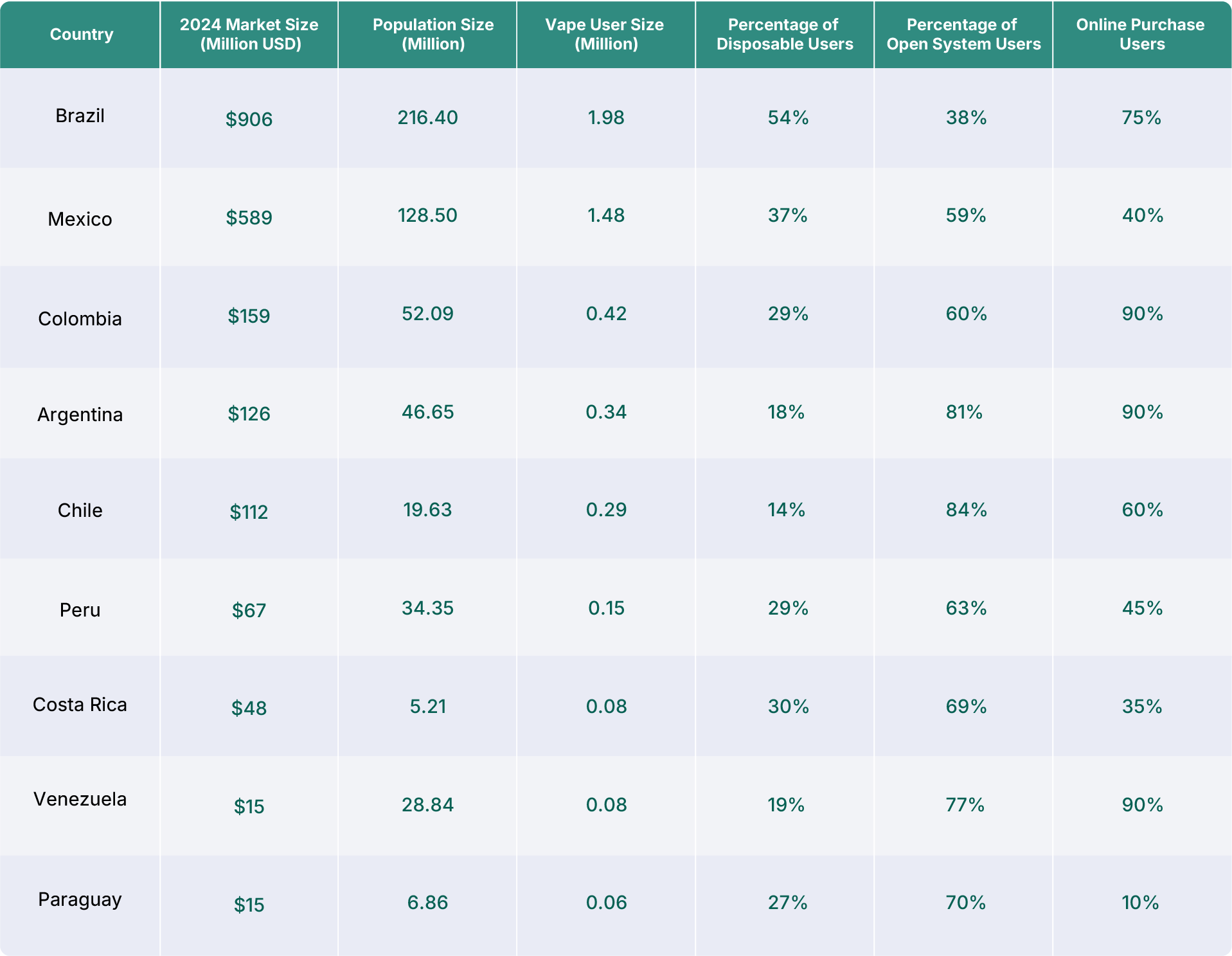

Brazil leads with a market size of $906 million, which could be much larger when including the black market, with a user base of around 2 million.

Mexico ($589 million) and Colombia ($159 million) rank second and third, with 1.48 million users in Mexico and 420,000 users in Colombia.

Other countries, such as Argentina, Chile, and Peru, have smaller market sizes (ranging from $126 million to $67 million), but user penetration is gradually increasing.

Regulatory for E-Cigarettes in South America

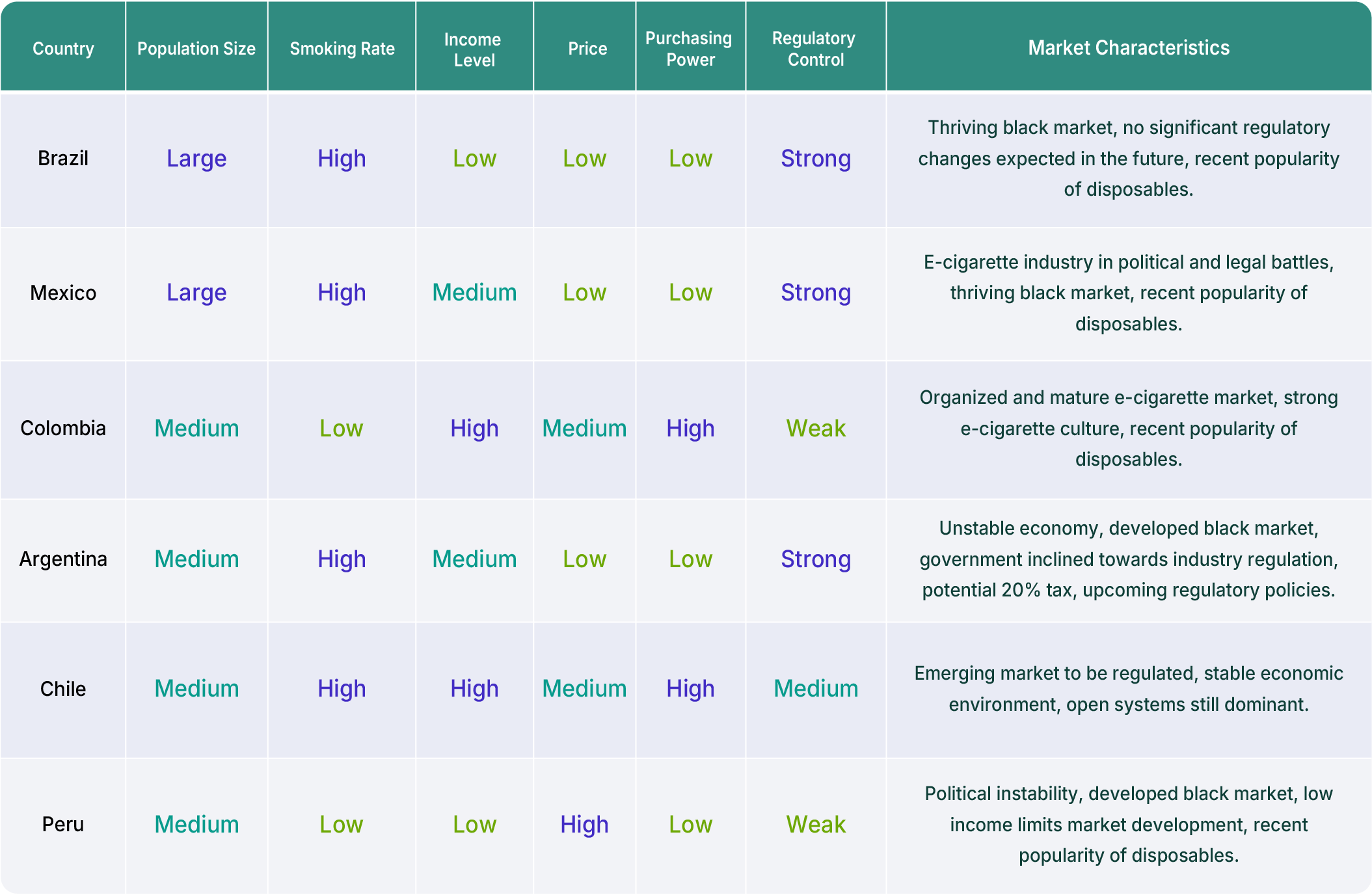

The regulatory policies for e-cigarettes vary significantly across South American countries, directly affecting the market landscape.

Countries with Bans

Brazil: E-cigarette sales have been banned since 2009 (including heated tobacco products), but black market trade dominates, with disposable vapes accounting for 54% of the market share.

Mexico: After the sales ban was implemented in 2022, the Supreme Court ruled the ban unconstitutional, as it restricted commercial freedom, leading to its dismissal. However, in December 2024, the proposal to enshrine the ban in the constitution was passed by the lower house, and stricter measures are on the way. Currently, disposable products account for 37%, primarily driven by the black market.

Venezuela: A comprehensive ban was introduced in 2023, shrinking the market size to $15 million, with users relying on unofficial channels.

Countries with Moving Toward Regulation

Chile: After new regulations come into effect from May 2024 to January 2025, the market will become regulated. Currently, open systems dominate, holding 84% of the market share, and the country’s economic stability supports the regulatory process.

Argentina: The government plans to introduce a 20% tax policy to encourage the shift from the black market to the regulated market, though economic volatility still limits development.

Countries with Looser Regulations

Colombia: Only basic safety standards are required, and the market is mature with a strong e-cigarette culture. 60% of users choose open systems, and 90% of purchases are made online.

Peru: Regulations are weak, but low income limits market growth. Disposable products account for 29% of the market, and the number of e-cigarette stores exceeds that of Colombia.

Product Types and User Preference

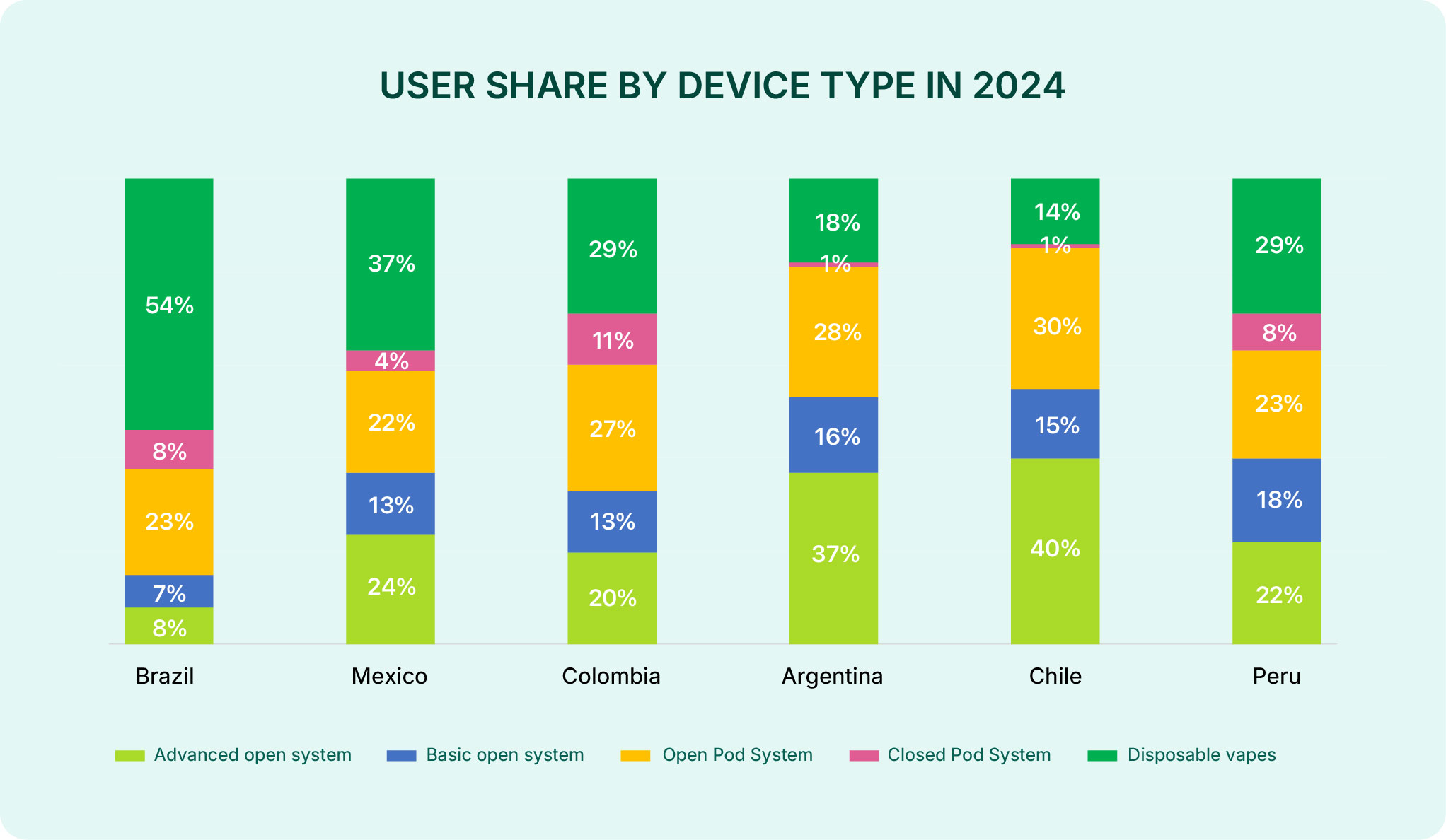

Disposable Vapes: More popular in black market-heavy regions, with (54%) of users in Brazil and (37%) in Mexico opting for disposable vapes.

Open Systems: Chile (84%), Argentina (81%), and Colombia (60%) prefer refillable devices. Brands like Vaporesso, Voopoo, and Uwell have a competitive advantage through online channels.

Closed Pod Systems: Gaining popularity in Costa Rica (30%) and Paraguay (27%), but still have a smaller market share compared to open systems.

Brazil: Black Market Prosperity Under Regulatory Pressure

Regulatory Environment

Since 2009, the sale of e-cigarettes (including heated tobacco products) has been completely banned, but enforcement is weak, with black market transactions accounting for over 70%. In 2024, Brazil’s Health Regulatory Agency (Anvisa) reiterated the ban but did not implement substantial enforcement measures.

Market Features

Market Size: About $1 billion (the largest in South America), with a user base of 1.98 million (actually closer to 3 million in 2025).

Product Preference: Disposable vapes account for 54%, and open systems account for 38%.

Flavor preferences: Through an analysis of the flavor of disposable vapes listed on e-commerce platforms in the Brazilian market, we found that the ranking by the number of products listed is as follows: fruit, mint, candy, beverage, dessert, and tobacco. This differs from Mexico, where beverage flavors are significantly more numerous than in Brazil, ranking third, followed by tobacco, with dessert flavors at the bottom.

Channels: 75% of users purchase online, but offline informal channels continue to grow due to their lower prices and convenience.

Challenges

Brazil is the largest e-cigarette market in South America, filled with e-cigarette entrepreneurs chasing their dreams of striking it rich. However, policy uncertainty has led compliant businesses to withdraw from the competition, while counterfeit local products flood the market. The quality of products sold on the black market is concerning, and local channels hold more influence, all of which hinder the healthy growth of the e-cigarette market. If you're a brave adventurer, this is an ideal high-risk, high-reward market.

Mexico: Resilient Demand Amid Legal Tug-of-War

Regulatory Environment

The Mexican e-cigarette market is currently facing a complex situation. In 2022, despite a presidential ban on the sale of e-cigarettes, the Supreme Court partially overturned the ban, allowing large retailers like Walmart to sell e-cigarettes.

However, on December 3, 2024, the Mexican lower house of Congress passed a constitutional amendment by a majority vote, aiming to completely ban the production, distribution, and sale of e-cigarettes and related devices. If the Senate approves it, the ban will officially take effect.

This ban will severely restrict the legal e-cigarette market in Mexico, making it difficult to loosen the restrictions in the short term. Currently, there are two main channels in the e-cigarette market: one is the high-priced e-cigarettes imported by legal companies, primarily sold at convenience stores and other retailers; the other is the low-priced e-cigarettes sold through black market channels, which account for 90% of the market and are controlled by organized crime. The new ban could completely eliminate the compliant market, further strengthening the black market's influence and making it more difficult for the government to effectively manage and regulate the market.

Market Features

Market Size: $589 million, with a user base of 1.48 million.

Product Preference: Open systems account for 59% (with brands like Vaporesso leading), and disposable vapes account for 37%.

Flavor preferences: In the Mexican market, in addition to the popular fruit and mint flavors, there is a strong preference for alcoholic beverage flavors. Local specialty drinks such as mezcal, caipirinha, tequila, and aperol can be found in many disposable e-cigarette brands.

Channels: 40% of users choose online purchases, but offline convenience stores (such as Oxxo) have become major sales points due to relaxed enforcement.

Challenges

The black market smuggles e-cigarettes across the U.S.-Mexico border. Its goal is to evade a 20% import tax and gain cost advantages, which creates significant challenges for compliant businesses. Policy uncertainty continues to hinder large companies from making long-term investments. For businesses familiar with black market operations, the latest policy changes in Mexico may be even more advantageous.

Colombia: High Purchasing Power and Strong Vape Culture

Regulatory Environment

There are no ingredient restrictions, only basic safety standards are required. In 2022, the government proposed a tax on e-liquids (tax rate undecided), raising concerns within the industry.

Market Features

Market Size: $159 million, with a user base of 420,000.

Product Preference: Open systems account for 60% (with Uwell and Voopoo leading), and disposable products account for 29%.

Channels: 90% of users rely on online platforms.

Opportunities

• With users who have strong purchasing power, spending an average of $380 per year (highest in South America). High-income groups (with a per capita GDP of $6,500) support the growth of premium e-liquid and vape brands.

• The e-cigarette culture is strong, with a mature market environment. Every year, large e-cigarette trade shows attract countless global e-cigarette brands and buyers from across South America to gather here.

• A stable policy environment is favorable for making long-term investments.

Argentina: Development Struggles Amid High Inflation

Regulatory Environment

In December 2023, the government planned to impose a 20% tax on e-cigarettes to encourage the shift from the black market to the regulated market. However, other more pressing issues, such as economic fluctuations, clearly impacted the further assessment and implementation of this plan.

Market Features

Market Size: $126 million, with third-party reports indicating 340,000 users. From an interview with Juan, the president of the Argentine E-cigarette Association, we learned that the user base may exceed 1 million.

Product Preference: Open systems account for 81%, while disposable vapes account for 18%.

Channels: 90% of users purchase online through social media and e-commerce platforms, as physical stores are closed due to regulatory restrictions.

Challenges

• High inflation (over 200% in 2023) and currency depreciation weaken consumers’ purchasing power, users prefer DIY and inexpensive open devices, making it difficult for High-priced e-cigarettes to compete on price.

• The black market dominates the market, smuggling through the Paraguay border to evade taxes, brand operations need to develop a secure and stable transportation route.

Opportunities

Policy changes are expected within the next two years, and the situation for the e-cigarette market looks favorable due to the more open stance on market liberalization under Javier Milei's leadership. However, there is still much uncertainty, as this issue has not yet become a priority for the government. Vape brands can start their marketing plans early to prepare for the full market opening.

Chile: Open System Dominance and a Well-Established Compliance Environment

Regulatory Environment

Law 21642, amending law 19419, regulates the sale, packaging, advertising, and use of e-cigarettes, non-nicotine devices, and heated tobacco products. It also requires product registration and ingredient disclosure, with full implementation starting in January 2025.

Market Features

Market Size: $112 million, with third-party reports indicating 290,000 users (actual user base likely exceeding 500,000).

Product Preference: Open systems account for 84%, while closed pod systems account for only 14%.

Channels: 60% of users purchase through offline specialty stores, supported by economic stability (4% inflation rate), which allows for higher-priced products.

Opportunities

• The stability brought by the new regulations could attract more international major brands, such as BAT, to enter the market.

• Strong demand for refillable devices, with an annual growth rate of 25%.

Peru: The Paradox of Low Income and Channel Expansion

Regulatory Environment

There are no clear regulations, but the government tolerates the existence of the black market, which accounts for 60% of the market.

Market Features

Market Size: $67 million, with a user base is larger than 150,000 (the exact number cannot be determined).

Product Preference: Disposable vapes account for 29% (with Elf Bar penetrating the market through a low-price strategy), while open systems account for 63%.

Channels: There are many vape stores, exceeding the number in Colombia, yet 45% of users still prefer online platforms.

Challenges

• With a per capita GDP of only $7,000, users spend less than $50 annually, limiting the development of premium products.

• The black market imports products through the Ecuadorian border to avoid a 15% tariff, brand operations need to develop a secure and stable transportation route..

Paraguay: South American Logistics Hub and Black Market Gateway

Regulatory Environment

There is no substantial regulation, and the government somewhat acquiesces to Paraguay as a key trade route for vape products in the Southern Cone.

Market Features

Market Size: $15 million, with a user base of 60,000.

Product Preference: Disposable vapes account for 27%, while open systems account for 70% (with local brand Life Pod Eco dominating the market).

Channels: Online channels account for only 10%, with the majority of users purchasing e-cigarettes through offline channels.

Strategic Value

• Low tariffs (5%) and lenient customs policies make Paraguay a logistics hub.

• It serves as a testing ground for innovative products and also has favorable conditions for developing the local e-liquid manufacturing industry in South America.

The South American e-cigarette market presents a dynamic mix of opportunities and challenges. The continued growth over the next few years is certain, but new brands entering the South American market need to be mindful of the evolving regulatory environment and the region’s unique market characteristics, developing diverse and dynamic strategies tailored to the market features of each country.

The future of the e-cigarette market will depend on the ability of governments to balance regulation with economic realities, and for businesses to adapt to the diverse needs of consumers across the region. With the right strategies, the market has the potential to transition from a black market-driven industry to a more regulated and sustainable one, benefiting both consumers and legitimate businesses alike.

ABOUT HANGSEN

Hangsen is one of the largest global e-liquid manufacturers. Since we established the industry’s manufacturing standards and introduced VG+PG as the base liquid for e-liquids, our business has expanded to over 80 countries and regions worldwide. The world’s top e-cigarette brands and tobacco enterprises are our loyal clients. Each year, we provide over 60,000 high-quality flavor formulations to hundreds of companies. Innovation, efficiency, safety, and stability are the cornerstones of our ongoing pursuit.

For inquiries about e-liquid OEM services in the South American market, please contact us at service@hangsen.com.