In 2024, according to multiple Middle East e-cigarette market analysis reports, the market size of the Middle East and North Africa (MENA) region is projected to exceed $1.2 billion. The Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE, Kuwait, Bahrain, Oman, and Qatar) contribute approximately 80% of the market share, serving as the core engine of regional growth. By 2025, the market is expected to surpass $1.5 billion.

The market growth is primarily driven by the following factors:

Young Population Dividend: Developed regions in the Middle East have a high proportion of young people (aged 18-35), forming the core consumer group for e-cigarettes, with a steady potential for market penetration. Additionally, the female user base in developed regions such as Saudi Arabia is expanding rapidly.

Shift in Smoking Culture and Health Awareness: Traditional hookah and cigarette consumption are widespread, and e-cigarettes, as a harm-reduction alternative, have gained broad acceptance, especially in countries with high tobacco taxes.

Improving Regulatory Environment: Countries such as Saudi Arabia and the UAE have developed regulatory frameworks that reference EU TPD standards, leading to more standardized and open policies. Neighboring countries are also following suit, leading the industry toward legalization and compliance, providing a more stable business environment for enterprises.

Duty-Free Economy and the Leverage of Travel Retail: Leveraging favorable duty-free policies and high-end consumption scenarios at airport retail outlets. Among them, premium disposable devices with higher price points dominate duty-free sales, accounting for over 50% of the total duty-free e-cigarette revenue.

Saudi Arabia: Market Leader, Strengthening Regulation to Promote Compliance

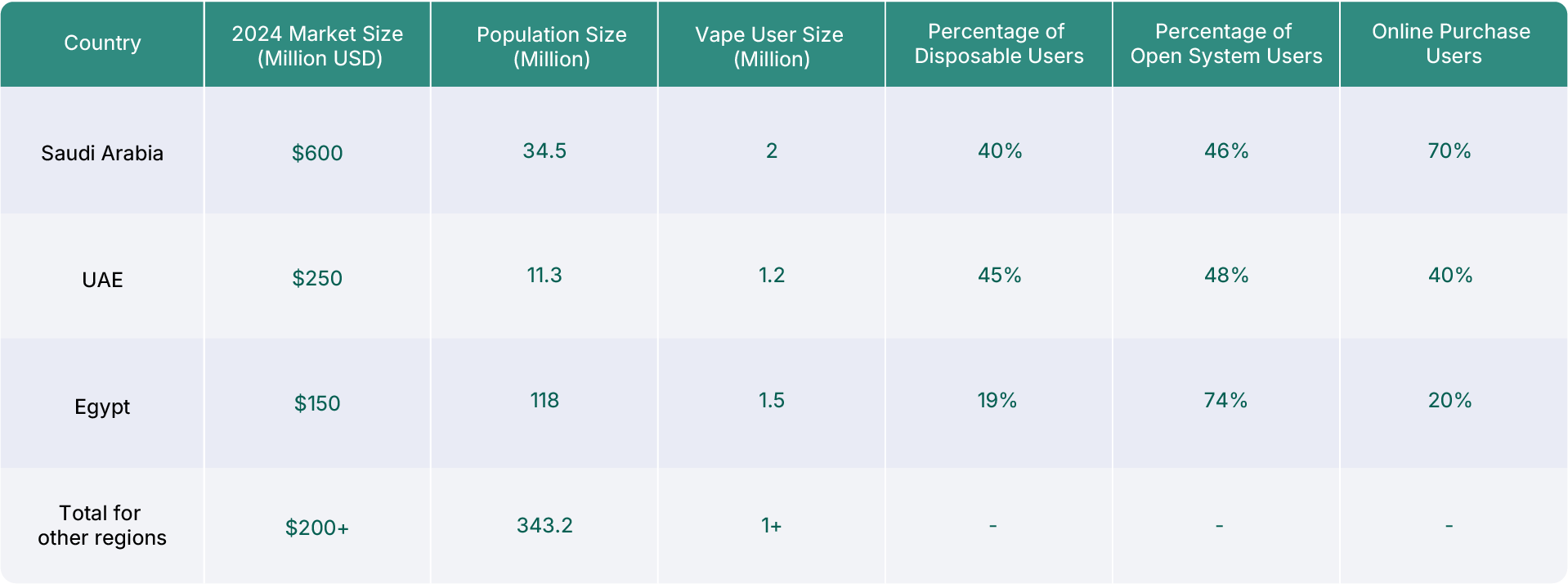

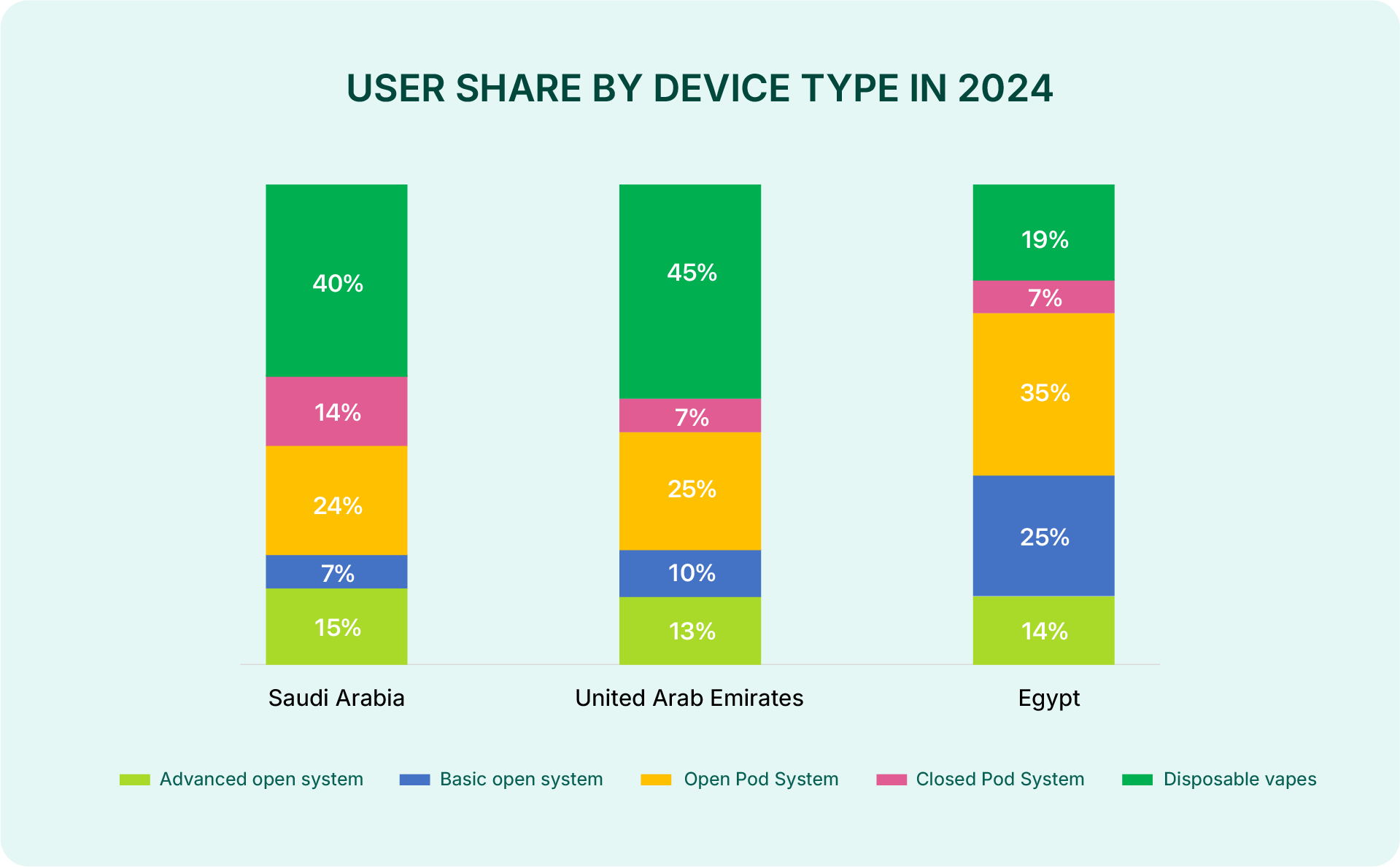

In 2024, the Saudi e-cigarette market is expected to reach $610 million, accounting for 62.2% of the MENA e-cigarette market, with a user base exceeding 2 million. Among them, the disposable e-cigarette segment accounts for over 40%, while open-system devices still hold more than 45% of the market share.

In 2023, the Saudi Food and Drug Authority (SFDA) implemented an e-cigarette certification system, referencing EU TPD standards to accelerate the market compliance process. Starting in July 2024, SFDA will further tighten regulatory standards, requiring e-cigarette products to meet stricter nicotine content and packaging regulations. The market is undergoing deep restructuring, with non-compliant brands gradually exiting. The Saudi SFDA certification led to the exit of small and medium-sized enterprises from the market, reducing the number of brands by 20% in 2024, while top companies increased their market share to 65%.

United Arab Emirates: High-End Market and Regional Distribution Hub

In 2024, the UAE e-cigarette market is projected to reach $250-300 million, with an annual compound growth rate (CAGR) of 30%. Dubai has become the e-cigarette supply chain and transshipment hub for the Middle East, handling over 50% of the regional e-cigarette trade.

Growing demand for high-tech disposable e-cigarettes is evident, with products featuring LED screens and adjustable settings gaining popularity, accounting for over 20% of the UAE market. The ESMA certification system enforces strict nicotine content and e-liquid capacity limits, but in Dubai's largest wholesale market, Dragon Mart, a large volume of high-nicotine and large-capacity non-compliant products remains available, indicating a relatively lax regulatory enforcement.

Many brands utilize Dubai’s free trade zone policies to export e-cigarette products to other Middle Eastern countries, such as Kuwait and Bahrain.

Egypt: Price-Sensitive Market Dominated by Open-System Devices

In Egypt, the e-cigarette market is projected to be worth $150-200 million, with over 1 million users. However, per capita spending on e-cigarettes is significantly lower than in Saudi Arabia, at only one-sixth of the Saudi average, making it a highly price-sensitive market.

As a result, open-system devices dominate the market, accounting for 70% of total sales. Among these, pod-based open systems have captured 35% of the market share, as they offer a refillable design and lower long-term cost, making them more appealing to cost-conscious consumers.

Disposable e-cigarettes account for less than 20% of total sales, with local low-end brands valued at less than $1 per unit, resulting in low profit margins. Egyptian consumers prefer low-cost, reusable e-cigarette devices over single-use options.

Unlike Saudi Arabia and the UAE, where online retail plays a significant role in vape sales, Egypt’s e-cigarette market primarily relies on offline distribution channels. Most sales occur through physical vape stores, convenience stores, and local distributors, as the country's e-commerce infrastructure is less developed.

The Egyptian government currently maintains a relatively relaxed regulatory stance, but future policies may introduce stricter tax and compliance measures, leaving uncertainty about the market’s long-term outlook.

Which Types of E-Cigarette Devices Are Most Popular in the Middle East?

The open-system remains the mainstream choice, though its market share has declined from 73% in 2022 to 62% in 2024. However, pod-based open-system devices have grown against the trend, reaching 38% market share in Egypt.

Disposable e-cigarettes are experiencing the fastest growth, with a penetration rate exceeding 40% in GCC countries. This figure is expected to rise to 58% by 2025. Device capacity has evolved from 2ml to 12ml, offering higher puff counts. In UAE and Saudi Arabia, high-tech disposable devices equipped with LED screens and adjustable power settings are becoming increasingly popular. In contrast, in lower-income countries, cost-effective disposable devices remain dominant.

Closed-system pod devices continue to struggle, holding an overall market share of around 10% in the Middle East. In Egypt, due to high price sensitivity, their penetration rate is below 7%. However, the Saudi Arabian market is expected to undergo structural changes, driven by strategic investments from international tobacco companies like BAT and adjustments in the regulatory framework, which could foster growth in this segment.

Which Vape Brands Are Popular in the Middle East?

Saudi Arabia

Top Disposable Vape Brands: Mazaj, Nasty, Oxbar, Elf Bar

Top E-Liquid Brands: Mazaj, Nasty, VGOD, Dr.Vapes, Ripe Vapes, Mega Vape, Sams Vape

Top Open-System Brands: Uwell, VOOPOO, Vaporesso, SMOK, OXVA

United Arab Emirates (UAE)

Top Disposable Vape Brands: Tugboat, Yuoto, Vozol, Mazaj, Nerd, Elf Bar,Vape Bars, Geek Bar, Nasty, Al Fakher

Top E-Liquid Brands: Tokyo, VGOD, Nasty, Mazaj, Dr.Vapes, Pod Salt, Sams Vape, Keep It 100, Ripe Vapes, Al Fakher

Top Open-System Brands: Uwell, Geek Vape, VOOPOO, Vaporesso, SMOK

Egypt

Top Disposable Vape Brands: Vozol, Oxbar, Nasty, Zooka, Elf Bar

Top E-Liquid Brands: Tokyo, Nasty Juice, Ripe Vapes, Bazooka Vapes, Chubby, Tribeca, VGOD

Top Open-System Brands: OXVA, SMOK, VOOPOO, Uwell, Vaporesso, Geek Vape

Top Vape Brands in the Middle East B2B Market

Nasty (Malaysia)

Product Type: E-liquids, Disposable Vapes

Market Performance:

Nasty is a globally recognized e-cigarette brand known for its bold fruit-mix flavors and high-quality e-liquids. It holds 15% of the Middle East e-liquid market, Top three overall. Saudi Arabia and the UAE contribute over 50% of its regional revenue. Nasty has established a comprehensive product distribution network across the Middle East, making it one of the most widely available vape brands in the region.

Nasty has launched the Hooqa disposable shisha vape in response to Middle Eastern market preferences, featuring flavors like Double Apple and Grape Mint. Additionally, Nasty is one of the leading brands in the Saudi and UAE e-liquid market, with its flagship flavors such as Cush Man and Slow Blow enjoying high distribution rates across mainstream retail outlets.

Tugboat (China)

.png)

Product Type: Disposable Vapes, Open-pod device

Tugboat is the best-selling Chinese vape brand in the Middle East, specializing in disposable vapes. With its competitive pricing and early market entry, it has secured a leading position in the region. According to a 2024 UAE e-cigarette market survey, Tugboat ranks among the best-selling disposable vape brands, holding over 10% of the market share. Its low-cost disposable models have high sales volume in Dubai’s Dragon Mart wholesale market. Tugboat reaches small and medium-sized retailers mainly through Dragon Mart.

.jpg)

Evo 4500 Puffs Disposable Vape – Priced at 20 AED (approx. $6.80 USD), this model is highly favored by beginners due to its exceptional affordability. With over 300,000 units sold per month in wholesale markets, it has been one of the best-selling models in Dragon Mart in recent years.

Tugboat EVO PRO Series (2024 Release) – Upgraded to 15,000 puffs, featuring an adjustable airflow system and LED battery display, enhancing the overall user experience.

Tugboat currently faces intensifying competition from other Chinese low-cost white-label brands, which may further compress profit margins in its budget-friendly product segment. Given that low-cost models account for a significant portion of its sales, maintaining profitability remains a challenge.

Product Type: Disposable Vapes, E-liquids

Founded in 2023, Yalla is an Emirati vape brand specializing in high-end, long-lasting disposable devices. It has become one of the most prominent homegrown vape brands in the Middle East, gaining significant market attention in 2024. Yalla’s CEO, Umran Khan, is a visionary entrepreneur with strong execution capabilities, driving the brand’s rapid growth in the UAE’s premium e-cigarette sector.

.jpg)

Yalla’s flagship Aura 18000 disposable vape features a digital screen displaying battery and e-liquid levels, catering to premium consumers in the UAE market. This device is particularly popular in high-end retail channels such as Dubai Airport Duty-Free and is one of the best-selling e-cigarette products in this category.

Al Fakher (UAE)

Product Type: E-liquids, Disposable Vapes

Al Fakher is a traditional Emirati shisha brand with a global market share exceeding 30%. In 2020, it expanded into the e-cigarette industry, launching the Crown Series disposable vapes, specifically targeting shisha smokers aged 25-45. By 2024, it had secured a notable market presence in the UAE, making it the leading local brand. Currently, over 50% of its sales come from shisha cafes and tobacco shops.

The Crown Bar series, including the Crystal 9000 (14ml) and Pro 12000 (18ml), features transparent e-liquid tanks for easy monitoring. Its signature flavors, such as Two Apples Ice, Grape Freeze, and Watermelon Rose, cater to traditional shisha enthusiasts. The brand offers nicotine levels ranging from 0% to 5%, appealing to a broad range of consumers.

As a globally recognized leader in the shisha industry, Al Fakher is still in the process of transitioning into the e-cigarette sector. Its shisha-flavored vape and e-liquid products, staying true to the brand’s authentic heritage, are well worth trying.

Vape Bars (UK)

Product Type: Disposable Vapes

Vape Bars is a UK-based brand focusing on affordable, high-nicotine disposable vapes. In 2024, it secured a notable market share in the UAE, ranking among the top 10 most recognized disposable vape brands in the Middle East.

.jpg)

Its Diamond Series (7000 puffs, 10ml e-liquid, 1600mAh battery, 20mg/ml nicotine) targets the premium disposable segment, while the Ghost Series (5000 puffs, 8ml, $6-$8 retail price) is aimed at budget-conscious consumers.

Vozol (China)

Product Type: Disposable Vapes

Vozol is a Chinese e-cigarette brand specializing in disposable vape devices, emphasizing affordability, portability, and a diverse range of flavors. The brand has rapidly expanded its market presence through a competitive pricing strategy and frequent SKU updates, including seasonal limited-edition flavors. In 2024, Vozol secured over 5% of the Middle Eastern e-cigarette market, ranking among the top ten brands in the region.

.jpg)

Vozol primarily focuses on disposable vapes, with flagship products such as the Vozol Star 6000 (6000 puffs), offering popular flavors like fruit and mint. These devices feature a pre-filled oil design, prioritizing ease of use and portability. Additionally, in the Middle East, the brand has launched VOZOL Gear Shisha 40000, a high-puff shisha-style device incorporating unique sound effects that mimic traditional shisha bubbling sounds, showcasing Vozol's strong product design capabilities.

Compared to other international premium brands, Vozol’s pricing is more aligned with consumers in emerging markets like Egypt, where affordability is a key factor. This leads to a high market acceptance rate.

Tokyo

.jpg)

Product Type: E-Liquids

Tokyo is an e-liquid brand with distinctive Japanese-style branding, founded in 2018. Initially produced by Chinese manufacturers under an OEM model, the brand has established itself as one of the most recognized and widely distributed bottled e-liquid brands in the Middle East. Tokyo specializes in cost-effective e-liquids, primarily offering fruit blends (such as Mango Ice and Blueberry Lemon) and classic tobacco flavors, catering to price-sensitive consumers in the mid-to-low-end market.

.jpg)

In Egypt, Tokyo holds the highest market share among e-liquid brands, with a penetration rate exceeding 30% among open-system device users. Its 30ml bottled e-liquid, priced at $2-$3 per bottle, is a popular choice among low-income consumers. In Saudi Arabia, Tokyo has entered the market through local distributors but faces strong competition from Malaysian brand Nasty Juice and regional brands like Mazaj.

In the UAE, Tokyo is one of the most popular e-liquid brands and is widely available in Dubai’s Dragon Mart wholesale hub. Tokyo’s cost per milliliter is 30% lower than that of European and American brands, giving it a significant pricing advantage in low-income markets like Egypt.

Pod Salt (UK)

.jpg)

Product Type: E-Liquids, Disposable Vapes

Pod Salt is operated by British e-cigarette giant Xyfil Limited, established in 2017 and headquartered in Manchester. In addition to Pod Salt, Xyfil also owns several other brands, including Doozy Vape and Nic Nic. Its parent company, Xyfil, has built a direct distribution network across the GCC countries through acquisitions and self-operated retail channels. The Middle East is currently its primary target market, and the brand operates MyVapery.com, an independent e-commerce platform mainly serving the UAE, Pakistan, and other Middle Eastern and surrounding regions.

(1).jpg)

The brand primarily sells Nicotine Salt e-liquids in the Middle East, available in 30ml bottles priced at 40 AED (~$10). It offers classic tobacco, mixed fruit, and other flavors, designed for open-system devices, and enjoys high brand recognition in the regional e-liquid market.

In terms of devices, Pod Salt mainly sells the GO series, with compact and practical, priced between 25-40 AED (~$7-$10), targeting the affordable segment with a focus on simplicity and ease of use.

.jpg)

Product Types: E-liquids, Disposable Vapes

VGOD is famous for its SaltNic nicotine salt e-liquids, such as Cubano (cigar flavor) and Lush Ice (watermelon ice). The brand also launched the STIG disposable vape series, holding a stable market share in the Middle East, making it a dominant brand in the high-end market.

.jpg)

Product Types: E-liquids, Disposable Vapes

.jpg)

Market Performance: Dr.Vapes is best known for its Pink Panther series e-liquids, specializing in high-quality freebase and high VG fruit-mixed flavors. As the influence of UK brands in the Middle East continues to expand, Dr.Vapes has experienced rapid growth in Saudi Arabia and the UAE, becoming a well-recognized brand in the premium vape market.

Sams Vape (Middle East)

Product Types: E-liquids, Disposable Vapes

Sams Vape is a locally recognized Middle Eastern brand primarily active in Saudi Arabia and the UAE. The brand has established a stable presence in the B2B wholesale market and vape shops. Its e-liquid lineup includes 60ml freebase and 30ml nicotine salt e-liquids, offering popular Middle Eastern flavors like Blast Berry Grape Xtrem and Mello Melon.

.jpg)

Additionally, Sams Vape has recently expanded its disposable vape product line, launching various flavors and sizes tailored for mainstream retail channels. This has enabled it to achieve strong penetration in both wholesale and retail markets in the Middle East.

Ripe Vapes (USA)

Product Types: E-liquids, Disposable Vapes

Ripe Vapes is renowned for its hand-crafted premium e-liquids. This brand has gained significant recognition in the region, particularly for its VCT series, which appeals to a niche group of discerning vapor users. One of the standout products is the VCT (Vanilla Custard Tobacco) flavor, which is consistently popular in high-end vape stores across the Middle East.

Ripe Vapes offers a diverse product line that includes disposable vapes and e-liquids, featuring flavors such as tobacco, creamy desserts, and mixed fruits, catering to vapers seeking sophisticated taste experience.

Middle East B2B E-Cigarette Market Trends and Opportunities

In recent years, the legalization of e-cigarettes in the Middle East has been steadily advancing. Countries such as Saudi Arabia, and UAE have established regulatory frameworks, with Saudi Arabia and the UAE adopting standards similar to the European Union’s TPD. This has led to a more structured and regulated e-cigarette market. The UAE, in particular, has emerged as the key trading hub for e-cigarettes in the region. With its Free Zone policies, Dubai has become a major logistics and distribution center, attracting international brands and wholesalers who use its strategic location to facilitate transshipment to Saudi Arabia, Kuwait, Bahrain, Oman, and other neighboring markets.

Localized Product Strategies

Middle Eastern consumers have distinct preferences for flavors and devices, making localization crucial for market success. Fruit flavors remain the most popular choice, while dessert flavors are gaining traction in the UAE due to its diverse consumer base. In contrast, Saudi Arabia and Egypt show stronger preferences for tobacco-based flavors, reflecting their long-standing hookah culture and traditional cigarette consumption habits. Tailoring products to cultural and sensory preferences is essential for deep market penetration and brand loyalty.

Localization also extends to packaging, branding, and product presentation. Many successful brands integrate Arabic cultural elements to enhance brand trust and appeal.

Yalla incorporates Arabic calligraphy and geometric patterns into its design, reinforcing local identity.

Some brands use Arabic terms to align with Middle Eastern aesthetics.

Premium brands add gold accents, embossed packaging, and intricate designs to match the Middle Eastern preference for luxury.

Brands also tailor flavor strategies by region:

Gulf markets favor coffee and date flavors, especially during Ramadan. leading some brands in the UAE and Saudi Arabia to launch Date Coffee and Date Caramel as limited edition flavors, catering to local preferences.

Promoting alcohol-free (Alcohol-Free) e-liquids in certain markets to comply with Sharia Law, increasing market acceptance in Saudi Arabia, Kuwait, and other religiously conservative countries. Some brands specifically develop alcohol-free products to ensure compliance with local regulations and enhance consumer trust.

Offering classic shisha flavors, such as Double Apple, Grape Mint, and Love 66, to meet the Middle Eastern preference for traditional hookah flavors.

Learn more about Hangsen SHISHA Flavor Solutions

Developing innovative tobacco flavors in countries with strong tobacco cultures, such as Saudi Arabia and Egypt, to cater to local consumers seeking alternatives to traditional cigarettes.

Our Middle East e-liquid flavor collection offers up to 44 different flavors to meet various consumer needs and preferences. Each flavor is meticulously crafted to ensure the best quality and experience.

learn more about Hangsen Middle East E-Liquid Flavor Collection

Market Opportunities and Industry Outlook

As the Middle Eastern e-cigarette market matures, investment and market consolidation are becoming more evident. International tobacco giants such as BAT and PMI are expanding their presence through local partnerships and acquisitions, driving industry growth. Meanwhile, local entrepreneurs are leveraging Chinese OEM manufacturers to develop customized products that cater to regional tastes and preferences.

With thousands of e-cigarette shipments processed daily at Dubai ports, the UAE continues to serve as the Middle East’s e-cigarette trade and re-export hub. Companies—whether tobacco firms, global e-cigarette brands, or local startups—use Dubai’s Free Zone policies to expand into Saudi Arabia, Kuwait, Oman, and beyond, accelerating their regional footprint.

Despite significant progress, many Middle Eastern markets remain underdeveloped. Countries like Kuwait, Bahrain, and Jordan have legalized e-cigarettes but still have low penetration rates, offering significant growth potential. In contrast, Qatar and Oman currently impose strict sales restrictions, but potential policy shifts could open up new opportunities.

Key Factors for Success in the Middle East

With over 300 million young consumers, high smoking rates, and increasing acceptance of e-cigarettes, the Middle East is rapidly emerging as one of the world’s largest e-cigarette markets.

We recommend that companies looking to expand into the Middle Eastern market:

✔ Ensure compliance with evolving regulations to establish trust and longevity.

✔ Offer localized products tailored to regional preferences and cultural nuances.

✔ Expand distribution networks through retail and e-commerce platforms.

✔ Optimize supply chains to enhance logistics efficiency and cost management.

As the market transitions from fragmented competition to regulated expansion, now is the ideal time for brands to establish a strong presence and secure long-term market positioning in the Middle East.

ABOUT HANGSEN

Hangsen is one of the largest global e-liquid manufacturers. Since we established the industry’s manufacturing standards and introduced VG+PG as the base liquid for e-liquids, our business has expanded to over 80 countries and regions worldwide. The world’s top e-cigarette brands and tobacco enterprises are our loyal clients. Each year, we provide over 60,000 high-quality flavor formulations to hundreds of companies. Innovation, efficiency, safety, and stability are the cornerstones of our ongoing pursuit.

For inquiries about e-liquid OEM services in the Middle East market, please contact us at service@hangsen.com.